CATEGORIES

- (3) Negotiating Tax Debt and Payment Arrangements with SARS

- (2)Account / Profile

- (539)Accounting

- (2)Accounting and Finance

- (22)Audit

- (156)Auditing and Assurance

- (1)Business

- (1)Business Management

- (3)Business Rescue

- (95)CIPC

- (7)Compliance

- (18)Ethics and Professionalism

- (46)Financial Reporting

- (1)Government Funding Applications

- (4)Guides

- (1)Individuals Tax

- (19)Law

- (37)Legal and Compliance

- (2)Management

- (5)Miscellaneous

- (22)Money Laundering

- (1)Personal & Professional Development

- (2)Practice Management

- (2)Professional Ethics

- (3)Public Sector

- (145)Regulatory Compliance and Legislation

- (41)SARS Issues

- (26)Sustainability Reporting

- (33)Tax

- (1)Tax Update

- (6)Technology

- (1)Wills, Estates & Trusts

- Show All

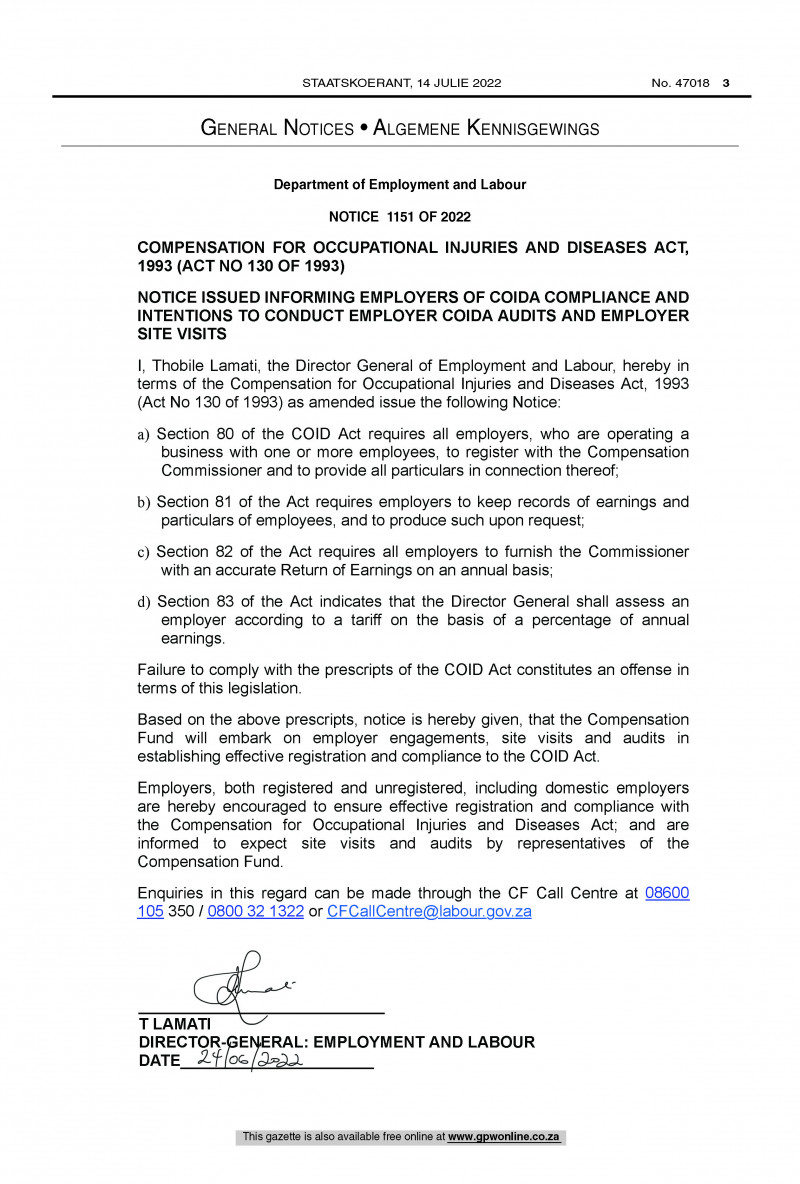

Employers: COIDA audits!

- 22 August 2022

- South African Accounting Academy

The Compensation Fund will embark on employer engagements, site visits and audits in establishing effective registration and compliance to the COID Act.

- Section 80 of the COID Act requires all employers, who are operating a business with one or more employees, to register with the Compensation Commissioner and to provide all particulars in connection thereof;

- Section 81 of the Act requires employers to keep records of earnings and particulars of employees, and to produce such upon request;

- Section 82 of the Act requires all employers to furnish the Commissioner with an accurate Return of Earnings on an annual basis;

- Section 83 of the Act indicates that the Director General shall assess an employer according to a tariff on the basis of a percentage of annual earnings.

Failure to comply with the prescripts of the COID Act constitutes an offense in terms of this legislation.

Based on the above prescripts, notice is hereby given, that the Compensation Fund will embark on employer engagements, site visits and audits in establishing effective registration and compliance to the COID Act.

Employers, both registered and unregistered, including domestic employers are hereby encouraged to ensure effective registration and compliance with the Compensation for Occupational Injuries and Diseases Act; and are informed to expect site visits and audits by representatives of the Compensation Fund.

Enquiries in this regard can be made through the CF Call Centre at 08600 105 350 / 0800 32 1322 or [email protected]

Correction Notice, this Gazette is replacing Government Gazette 47016 that was Published on the 14th of July 2022 with General Notice No. 1150.

Click here to download the Notice:

https://www.gov.za/sites/default/files/gcis_document/202207/47018gen1151.pdf

Relevance to Auditors, Independent Reviewers & Accountants:

- The COID Act is yet another piece of legislation that your clients must comply with, and which you must assess compliance with. If they don’t comply with the relevant laws and regulations, you have certain reporting obligations in terms of NOCLAR (NOn-Compliance with Laws And Regulations) – this could include reporting to management, qualifying your audit opinion, reporting a Reportable Irregularity, etc.

- As an employer, you also need to comply with the COID Act in your workplace.

Relevance to Your clients:

- An entity (company or close corporation) has a duty to comply with the COID Act, otherwise it is regarded as an offense, and they could be held liable.

- The COID Act requires all employers, who are operating a business with one or more employees, to:

- register with the Compensation Commissioner and to provide all particulars in connection thereof;

- keep records of earnings and particulars of employees, and to produce such upon request;

- furnish the Commissioner with an accurate Return of Earnings on an annual basis;

- the Director General shall assess an employer according to a tariff on the basis of a percentage of annual earnings.

- Employers, both registered and unregistered, including domestic employers are hereby encouraged to ensure effective registration and compliance with the Compensation for Occupational Injuries and Diseases Act; and are informed to expect site visits and audits by representatives of the Compensation Fund.

To stay current with all the latest changes and updates subscribe to our Monthly Compliance and Legislative Update series for R 250.00 per month. This gives you access to a monthly 2-hour webinar and monthly newsletter:

https://accountingacademy.co.za/profession/monthly-legislation-update

Get all your CPD online. SA Accounting Academy (SAAA) offers Subscription Plans, Live Webinars, Webinars On-Demand, Access to Experts, Courses, Articles and more:

https://cpd.accountingacademy.co.za.

Our Content

Live Webinars

View upcoming live accounting and practice management webinars.

Learn MoreWebinars On-Demand

Browse our extensive range of relevant accounting and practice management webinars.

Learn MoreCourse

Browse our relevant and practical online courses.

Learn MoreCPD Subscription Plans

Access to professional and technical content that ensures both your knowledge and skills are maintained.

Learn MoreLegislation

Access updated legislation including amendments.

Learn MoreTechnical FAQs

A source of commonly asked technical accounting questions.

Learn More