CATEGORIES

- (4) Negotiating Tax Debt and Payment Arrangements with SARS

- (2)Account / Profile

- (551)Accounting

- (2)Accounting and Finance

- (29)Audit

- (156)Auditing and Assurance

- (1)Business

- (1)Business Management

- (3)Business Rescue

- (102)CIPC

- (7)Compliance

- (18)Ethics and Professionalism

- (46)Financial Reporting

- (1)Government Funding Applications

- (4)Guides

- (1)Individuals Tax

- (28)Law

- (37)Legal and Compliance

- (2)Management

- (13)Miscellaneous

- (29)Money Laundering

- (1)Personal & Professional Development

- (2)Practice Management

- (2)Professional Ethics

- (3)Public Sector

- (145)Regulatory Compliance and Legislation

- (41)SARS Issues

- (29)Sustainability Reporting

- (42)Tax

- (1)Tax Update

- (9)Technology

- (1)Wills, Estates & Trusts

- Show All

Maximum Monetary Fines in terms of Auditing Profession Act

- 13 October 2022

- Accounting

- South African Accounting Academy

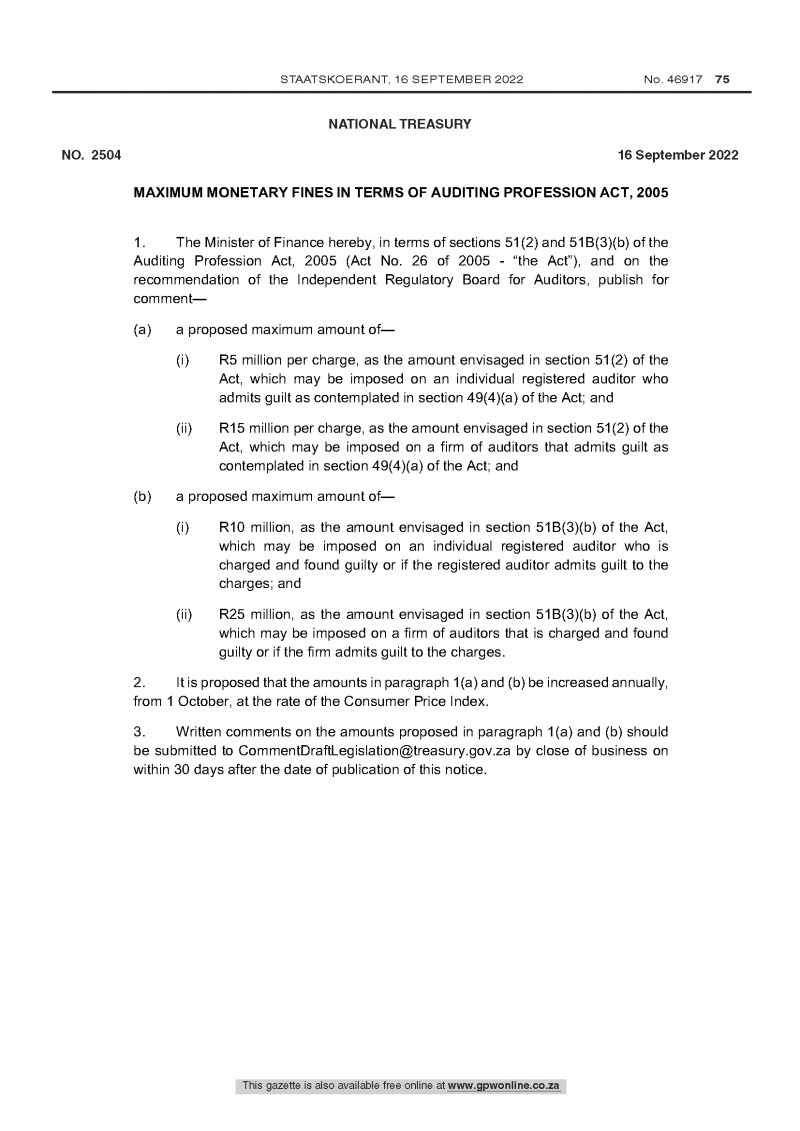

New proposed maximum amounts for different categories are as follows:

- A proposed maximum amount of—

- R5 million per charge, as the amount envisaged in section 51(2) of the Act, which may be imposed on an individual registered auditor who admits guilt as contemplated in section 49(4)(a) of the Act; and

- R15 million per charge, as the amount envisaged in section 51(2) of the Act, which may be imposed on a firm of auditors that admits guilt as contemplated in section 49(4)(a) of the Act; and

- A proposed maximum amount of—

- R10 million, as the amount envisaged in section 51B(3)(b) of the Act, which may be imposed on an individual registered auditor who is charged and found guilty or if the registered auditor admits guilt to the charges; and

- R25 million, as the amount envisaged in section 51B(3)(b) of the Act, which may be imposed on a firm of auditors that is charged and found guilty or if the firm admits guilt to the charges.

It is proposed that the amounts in paragraph 1(a) and (b) be increased annually, from 1 October, at the rate of the Consumer Price Index.

Due date for comments to CommentDraftLegislation@treasury.gov.za = 16 October 2022

Click here to download the Gazette Notice:

https://www.irba.co.za/upload/GG%20Notice%2046917%20No_%202504.pdf

Relevance to Auditors, Independent Reviewers & Accountants:

- The Auditing Profession Amendment Act, Act 5 of 2021 was signed into law by the President and gazetted on 26 April 2021. The effect was to give the Independent Regulatory Board for Auditors (IRBA) the necessary powers to deliver more effectively on its mandate and removing some of the limitations of the Auditing Profession Act 26 of 2005 (the Act) before this amendment.

- In terms of sections 51(2) and 51B(3)(b) of the Act the Minister must determine the amount referred to in the [relevant] subsection and on the recommendation of the Regulatory Board after publishing in the Gazette the proposed amount for comment for at least 30 days.

- As a registered auditor and member of IRBA, you need to be aware of the penalties that apply to you in terms of IRBA’s Disciplinary Process.

To stay current with all the latest changes and updates subscribe to our Monthly Compliance and Legislative Update series for R 250.00 per month. This gives you access to a monthly 2-hour webinar and monthly newsletter:

https://accountingacademy.co.za/profession/monthly-legislation-update

Get all your CPD online. SA Accounting Academy (SAAA) offers Subscription Plans, Live Webinars, Webinars On-Demand, Access to Experts, Courses, Articles and more:

https://cpd.accountingacademy.co.za.

Our Content

Live Webinars

View upcoming live accounting and practice management webinars.

Learn MoreWebinars On-Demand

Browse our extensive range of relevant accounting and practice management webinars.

Learn MoreCourse

Browse our relevant and practical online courses.

Learn MoreCPD Subscription Plans

Access to professional and technical content that ensures both your knowledge and skills are maintained.

Learn MoreLegislation

Access updated legislation including amendments.

Learn MoreTechnical FAQs

A source of commonly asked technical accounting questions.

Learn More