CATEGORIES

- (4) Negotiating Tax Debt and Payment Arrangements with SARS

- (2)Account / Profile

- (551)Accounting

- (2)Accounting and Finance

- (29)Audit

- (156)Auditing and Assurance

- (1)Business

- (1)Business Management

- (3)Business Rescue

- (102)CIPC

- (7)Compliance

- (18)Ethics and Professionalism

- (46)Financial Reporting

- (1)Government Funding Applications

- (4)Guides

- (1)Individuals Tax

- (28)Law

- (37)Legal and Compliance

- (2)Management

- (13)Miscellaneous

- (29)Money Laundering

- (1)Personal & Professional Development

- (2)Practice Management

- (2)Professional Ethics

- (3)Public Sector

- (145)Regulatory Compliance and Legislation

- (41)SARS Issues

- (29)Sustainability Reporting

- (42)Tax

- (1)Tax Update

- (9)Technology

- (1)Wills, Estates & Trusts

- Show All

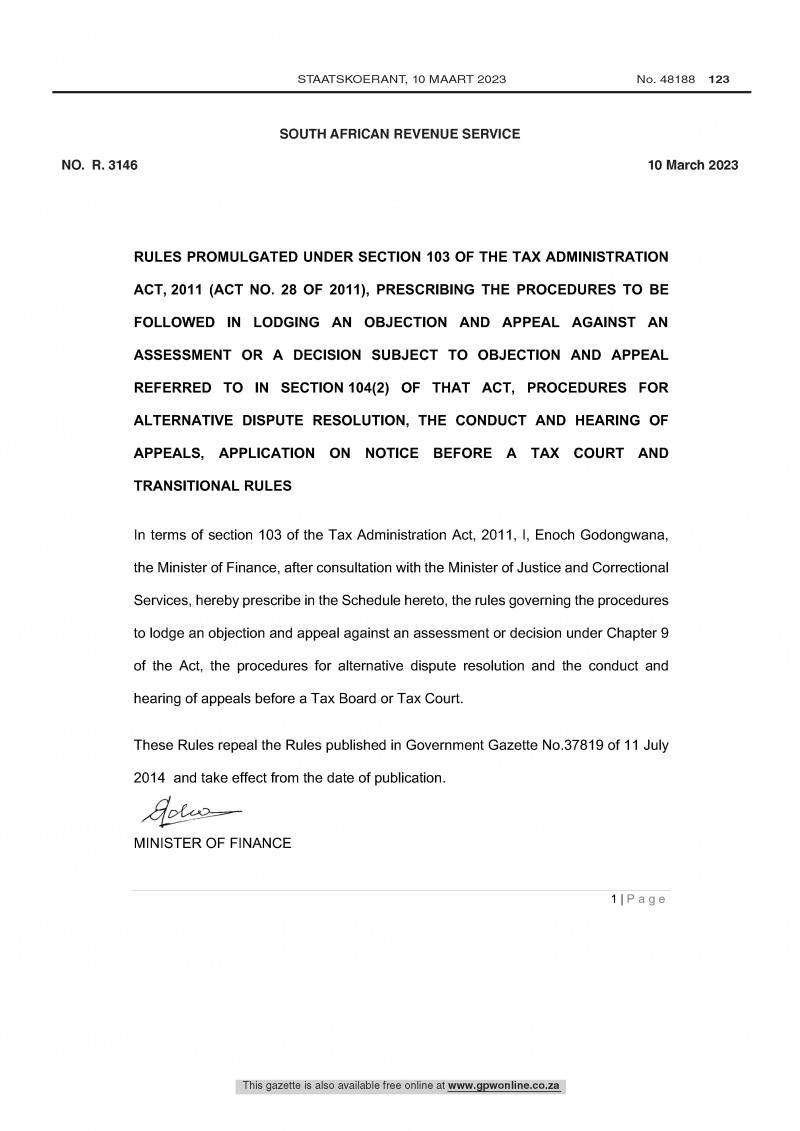

NEW! SARS Dispute Rules

- 13 March 2023

- Accounting

- South African Accounting Academy

These rules govern the procedures to lodge an objection and appeal against an assessment or decision under Chapter 9 of the Act, the procedures for alternative dispute resolution and the conduct and hearing of appeals before a Tax Board or Tax Court.

Transitional measures include among other things, that the new rule take into consideration and provide for:

- specific requests in respect of procedural matters taken or instituted under the previous rules but not completed by the commencement date of their repeal and replacement

- documents delivered under the previous rules, and

- replies to statements of grounds of appeal before the new rules came into force.

These Rules repeal the Rules published in Government Gazette No.37819 of 11 July 2014.

Click here to download the New Dispute Rules:

Relevance to Auditors, Independent Reviewers & Accountants:

- The Tax Administration Act is yet another piece of legislation that your clients should consider, so that they are aware of their rights and responsibilities with specific references to SARS’ powers.

- As an auditor, independent reviewer, accountant or tax practitioners you need to be aware of the latest rules that govern disputes with SARS.

Relevance to Your clients:

- A taxpayer should be aware of the contents of the Tax Administration Act.

- Taxpayers also need to be aware of the latest rules that govern disputes with SARS.

To stay current with all the latest changes and updates subscribe to our Monthly Compliance and Legislative Update series for R 250.00 per month. This gives you access to a monthly 2-hour webinar and monthly newsletter:

https://accountingacademy.co.za/profession/monthly-legislation-update

Get all your CPD online. SA Accounting Academy (SAAA) offers Subscription Plans, Live Webinars, Webinars On-Demand, Access to Experts, Courses, Articles and more:

https://cpd.accountingacademy.co.za.