Our Content

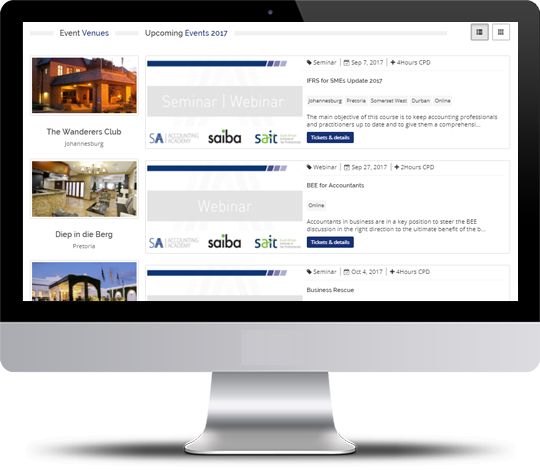

Upcoming Live Webinars

May

28

Monthly Compliance and Legislation Update - May

Presenter Lettie Janse van Vuuren CA(SA)

Apr

23

Monthly Compliance and Legislation Update - April

Presenter Lettie Janse van Vuuren CA(SA)

Apr

24

Managing difficult conversations

Presenter Annelien Feldtmann

Apr

29

The Accountant's Guide to Flawless Share Registers

Presenter Stephanie Maritz

May

14

2024 IRBA Inspection Report

Presenter Lettie Janse van Vuuren CA(SA)

Resources On Demand

NDT 2025 Training Series

Presenter

Beneficial Ownership 2025 Update

Presenter Caryn Maitland CA(SA)

The Companies Amendment Act 2024 and Second Companies Amendment Act 2024

Presenter Edith Wilkins

Non-compliance with laws and regulations (NOCLAR)

Presenter Caryn Maitland CA(SA)

Monthly Compliance and Legislation Update - February

Presenter Lettie Janse van Vuuren CA(SA)

Popular Courses

Delve into the realm of financial statement compilation with our Professional Certificate course. Master IFRS for SMEs, ISRS 4410, and the IESBA Code. Enhance your proficiency with hands-on Draftworx tutorials and comprehensive modules. Join SA Accounting Academy for unparalleled expertise.

Financial analysis is applied to better understand the performance of a company. It is a critical tool with a wide range of applications in the financial services sector.

Discover the Trainee Accountant Bootcamp by Accounting Academy. An online course covering soft / life skills, professional development, and technical competencies in accounting. No prerequisites required. Enroll now!

Qualifications

Elevate your career with SA Accounting Academy's National Certificate in Banking NQF 5. This 12-month, online, BANKSETA-accredited course prepares you for success in finance.

Unlock advanced accounting opportunities with the Certificate: Accounting at NQF Level 5. This qualification prepares you for higher-level roles in accounting and bookkeeping, providing in-depth knowledge and expertise. Delivered online by SA Accounting Academy, it offers the flexibility to balance ...

Achieve recognition in the accounting industry with the Certificate: Accounting Technician at NQF Level 3. This respected qualification equips you with essential skills for roles such as accounts clerk, accounts assistant, tax assistant, and junior bookkeeper. Delivered online by SA Accounting Acade...

Helpful Technical FAQs

Relevant Legislation

Auditing Profession Act, 2005 (Act No. 26 of 2005)

Close Corporations Act, 1984 (Act No. 69 of 1984)

Companies Act, 2008 (Act No. 71 of 2008)

Income Tax Act, 1962 (Act No. 58 of 1962)

Tax Administration Act, 2011 (Act No. 28 of 2011)

Value-Added Tax Act, 1991 (Act No. 89 of 1991)

Skills Development Act, 1998 (Act No. 97 of 1998)

Labour Relations Act, 1995 (Act No. 66 of 1995)

Broad-Based Black Economic Empowerment Act, 2003 (Act No. 53 of 2003)

Employment Equity Act, 1998 (Act No. 55 of 1998)

Basic Conditions of Employment Act, 1997 (Act No. 75 of 1997)

Compensation for Occupational Injuries and Diseases Act, 1993 (Act No. 130 of 1993)

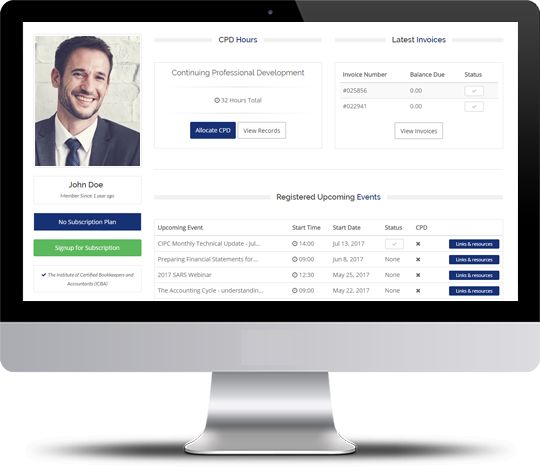

CPD Subscription Plans

Individual Subscription Plans

Are you looking to upskill yourself and develop your accounting knowledge and skills? These subscription plans give you access to professional and technical content, so you remain professionally competent. From R 250.00 per month.

Practice Subscription Plans

Are you looking to upskill your staff and develop their accounting knowledge and skills? This subscription plan gives you and your employees access to professional and technical content, so your business remains relevant and professionally competent. From R 139.00 per user per month (for three or more user).

Our Accreditations

What our clients have to say

G.K. (SA Accounting Academy Subscriber) |

M.W. (SA Accounting Academy Subscriber) |

T.S. (SA Accounting Academy Subscriber) |

N.C. (SA Accounting Academy Subscriber) |